HVAC Services

Get Professional Repairs From The Area's Trusted HVAC Technicians. Ask About Our Services! We Offer Professional Heating & Cooling System Repairs And Guarantee Long-Lasting Results.

Got Question? Call us: (850) 678-2665Financing

The Relationship Between HVAC And Home Insurance

Explore how your home's HVAC system can impact insurance costs. Discover surprising links and insightful tips to potentially lower your premiums today!

Have you ever wondered how the heating, ventilation, and air conditioning system (HVAC) in your home could influence your home insurance costs? It might seem unlikely that a system responsible for keeping your home comfortable can also play a role in determining your insurance premiums, but the truth is, there’s a fascinating connection. Buckle up as we explore this intriguing relationship and offer some helpful insights along the way.

Understanding HVAC Systems

First things first, let’s break down what an HVAC system actually is. HVAC stands for Heating, Ventilation, and Air Conditioning. This system is a crucial part of your home’s infrastructure, responsible for regulating indoor climate, ensuring your comfort, and maintaining air quality. From heating your home during chilly winter nights to providing a cool oasis in the heat of summer, HVAC systems are your behind-the-scenes climate heroes.

Components of HVAC

To truly grasp how your HVAC affects your home insurance, it helps to know the components involved. At a basic level, an HVAC system includes:

- Heating Unit: Typically a furnace or heat pump, responsible for warming your home.

- Ventilation System: This involves ducts and vents that distribute and circulate air throughout your home.

- Air Conditioning Unit: Keeps your home refreshingly cool during warmer months.

Each component plays a role in your home’s climate control, and their condition could surprisingly impact your insurance premiums.

The Impact of HVAC on Home Insurance

You might be scratching your head and thinking, “Why would my home insurance care about how I stay cool or warm?” Well, here’s the scoop: Insurance companies assess various factors to determine your premiums, and your home’s risk profile is a major consideration.

HVAC’s Role in Risk Assessment

Homes with well-maintained HVAC systems often pose a lower risk. But how, you ask? Here’s the thing: First, HVAC systems can reduce the likelihood of major incidents, like fires, which are costly to insurers. Secondly, a well-functioning HVAC system can prevent issues like mold or water damage, particularly if your system controls humidity. Lastly, modern HVAC systems might incorporate fire prevention measures, adding another layer of safety.

When insurance providers evaluate your house, they look at the condition and age of your systems, including HVAC. A newer, meticulously maintained system suggests that your home is less likely to suffer from catastrophes related to heating or cooling failures.

The Age of Your HVAC System

The age of your HVAC system is a crucial factor. Older systems may lack the advanced safety features found in newer models, potentially putting your home at a higher risk for certain types of damage. Insurance companies recognize this and might adjust your premiums to reflect the increased risk associated with outdated systems.

Conversely, investing in a new HVAC system not only improves home efficiency but may positively impact your insurance costs. With updates come enhanced technologies and safety features, something insurers are happy to acknowledge in their pricing.

Inspections and Maintenance

Another layer of importance lies in regular inspections and maintenance routines. Much like changing the oil in your car to keep it running smoothly, conducting regular maintenance checks on your HVAC system can prevent future headaches.

HVAC Maintenance Tips

Maintaining an HVAC system isn’t all technical jargon and hefty service bills. Some simple practices can keep your system running well:

- Change Filters Regularly: Filters should be changed or cleaned according to the manufacturer’s recommendation, usually every one to three months. This not only keeps indoor air quality high but also ensures the system runs efficiently.

- Seasonal Inspections: Have a professional inspect your HVAC at least twice a year, ideally before winter and summer. They can identify potential issues before they become expensive problems.

- Keep the Area Clear: Make sure the area around your HVAC unit is free of debris, dust, and obstructions to ensure proper airflow and efficiency.

The Link with Insurance Premiums

Regular maintenance and timely inspections can lower your home insurance premiums. Proactive care decreases the chances of a breakdown or issue leading to a claimable incident. In fact, some insurance companies might even offer discounts to homeowners who conduct annual HVAC inspections, making it a win-win for your wallet and peace of mind.

Energy Efficiency and Insurance

Another interesting wrinkle in the HVAC-insurance dynamic is energy efficiency. Today’s insurance companies are increasingly environmentally conscious and promote eco-friendly practices.

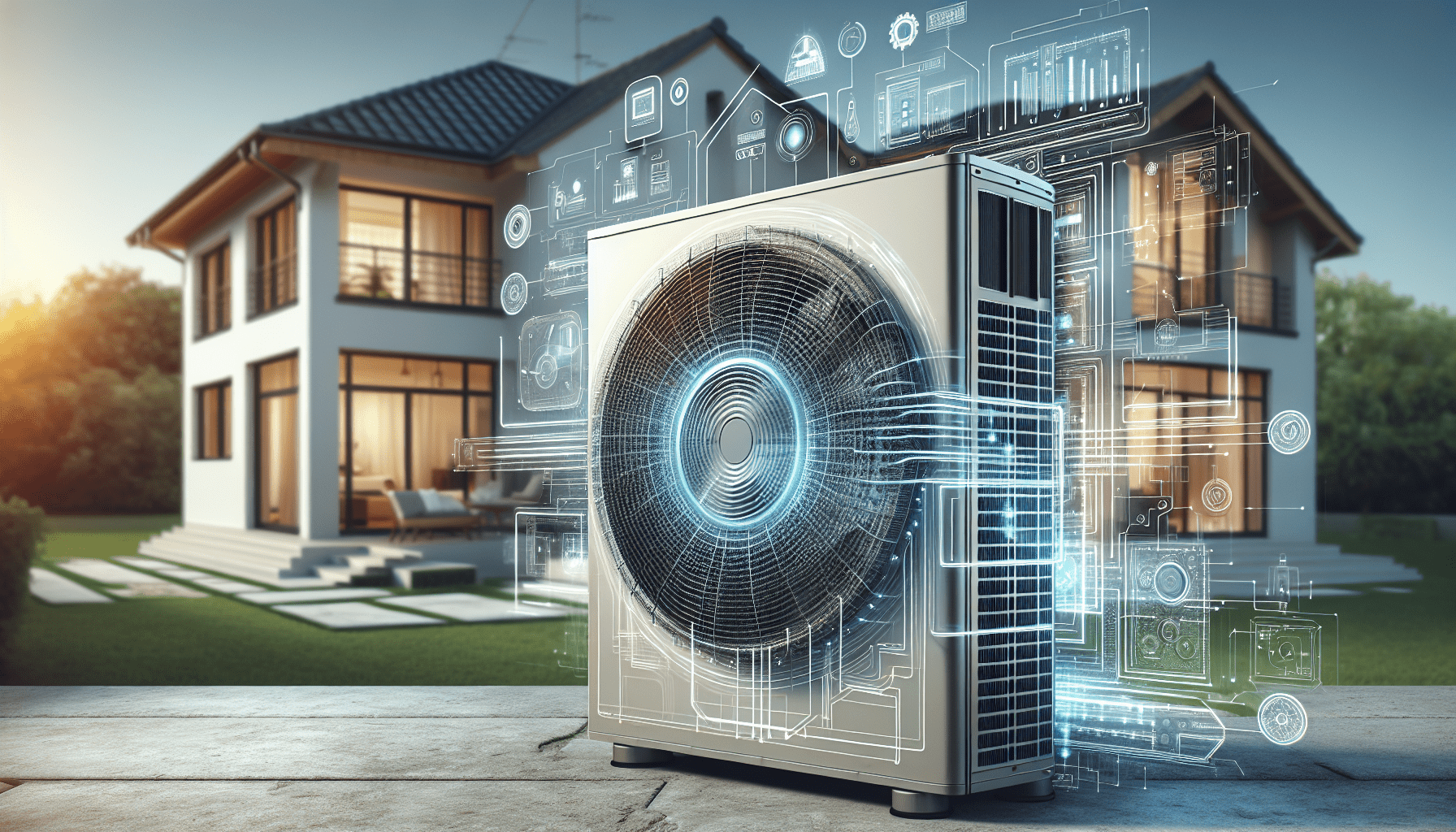

Energy-Efficient HVAC Systems

Opting for energy-efficient systems can reflect positively on your insurance premiums. Newer HVAC models are designed not only for optimal performance but also to consume less energy. Lower energy consumption often aligns with reduced operational risks, hence, potentially lower insurance premiums.

So, if you’re thinking about updating your HVAC system, consider choosing a model with an Energy Star rating or similar certification. Not only will you save on energy bills, but you might also see a reduction in your insurance costs.

Incentives for Green Practices

Some insurance policies include incentives for going green. If your policy offers such incentives, you might enjoy perks such as reduced premiums or additional discounts. Therefore, it’s wise to check in with your insurance provider about any green-related discounts that could be available to you.

HVAC-Related Claims and Their Impact

There are certain situations where an HVAC system could lead to insurance claims, affecting your relationship with your provider.

Common HVAC-Related Claims

Here’s what you should watch out for:

- Fire Risks: Poorly maintained HVAC systems can pose a fire risk, especially from faulty wiring or clogged vents.

- Water Damage: In regions with higher humidity, HVAC systems could be responsible for water leaks or mold growth if not properly maintained.

- Carbon Monoxide Leaks: Furnaces and boilers, part of the heating aspect of HVAC systems, can emit carbon monoxide if ventilation fails.

Preventive Measures to Avoid Claims

Preventing such incidents starts with understanding and action. Regular inspections and maintenance are your first defense. You might also consider:

- Installing carbon monoxide detectors in strategic areas of your home.

- Keep a close watch on your system’s condition.

- Immediately addressing any signs of leaks or malfunction.

A clean record of claims regarding HVAC issues can keep your insurance premiums in check, avoiding any sudden spikes that could otherwise occur.

The Role of Professional HVAC Services

Navigating the delicate relationship between HVAC systems and home insurance is no small feat. This is where professional services come into play.

Why Choose Professional Services?

While DIY maintenance can be effective for minor tasks, there’s no substitute for professional expertise. Trained technicians not only ensure your system’s longevity but also provide valuable insights into improving its energy efficiency and safety features.

Recommended Professional Services

When looking for HVAC professional assistance, considering a reputable provider like Tempacure Heating and Air Conditioning in Niceville, FL, can be a smart step. They offer a range of services that can help you maintain an optimal system and potentially safeguard your home insurance rates by keeping your household systems in prime condition. Here’s their contact information:

- Address: 325 Cedar Ave S, Suite B, Niceville, FL 32578

- Phone: (850) 678-2665

- Website: Tempacure Heating and Air Conditioning

With a company like Tempacure, you gain peace of mind knowing your HVAC system is being cared for by experienced professionals who prioritize both function and safety.

Communicating with Your Insurance Provider

Given the potential implications of your HVAC system on your home’s insurance, it’s crucial to keep an open line of communication with your insurance provider.

Points to Discuss

When speaking with your insurance agent, consider bringing up:

- System Updates: Inform them of any recent updates or upgrades to your HVAC system.

- Maintenance Records: Keeping records and receipts of professional maintenance can sometimes result in discounts or incentives.

- Energy Efficiency: Ask about potential discounts for energy-efficient systems.

Ask for Clarifications

Don’t shy away from asking for clarification if you’re unsure about how your HVAC affects your insurance. Agents are there to help, and understanding these nuances can empower you to make better-informed decisions to protect your home and your budget.

Conclusion

The relationship between your HVAC system and your home insurance is more interconnected than you might initially think. By ensuring your HVAC system is up-to-date, well-maintained, and energy-efficient, you can positively influence your home’s safety profile and potentially benefit from lower insurance premiums. Regular maintenance, timely updates, and open communication with your insurance provider are key strategies in navigating this relationship.

As you sip your coffee on a perfectly climate-controlled morning, take a moment to appreciate the unseen ally that is your HVAC system, keeping you comfortable while sneakily influencing your insurance experience.