HVAC Services

Get Professional Repairs From The Area's Trusted HVAC Technicians. Ask About Our Services! We Offer Professional Heating & Cooling System Repairs And Guarantee Long-Lasting Results.

Got Question? Call us: (850) 678-2665Financing

Exploring Energy Tax Credits For HVAC Upgrades

Unlock energy savings with HVAC upgrades! Discover how energy tax credits can help you save money, improve comfort, and reduce your environmental impact. Dive in now!

Have you ever wondered how you can make your home more energy-efficient, save money, and possibly help the environment all at once? Upgrading your HVAC system with the help of energy tax credits might be the solution you’re looking for. It sounds like a lot to digest, but don’t worry — it’s not nearly as complicated as it seems.

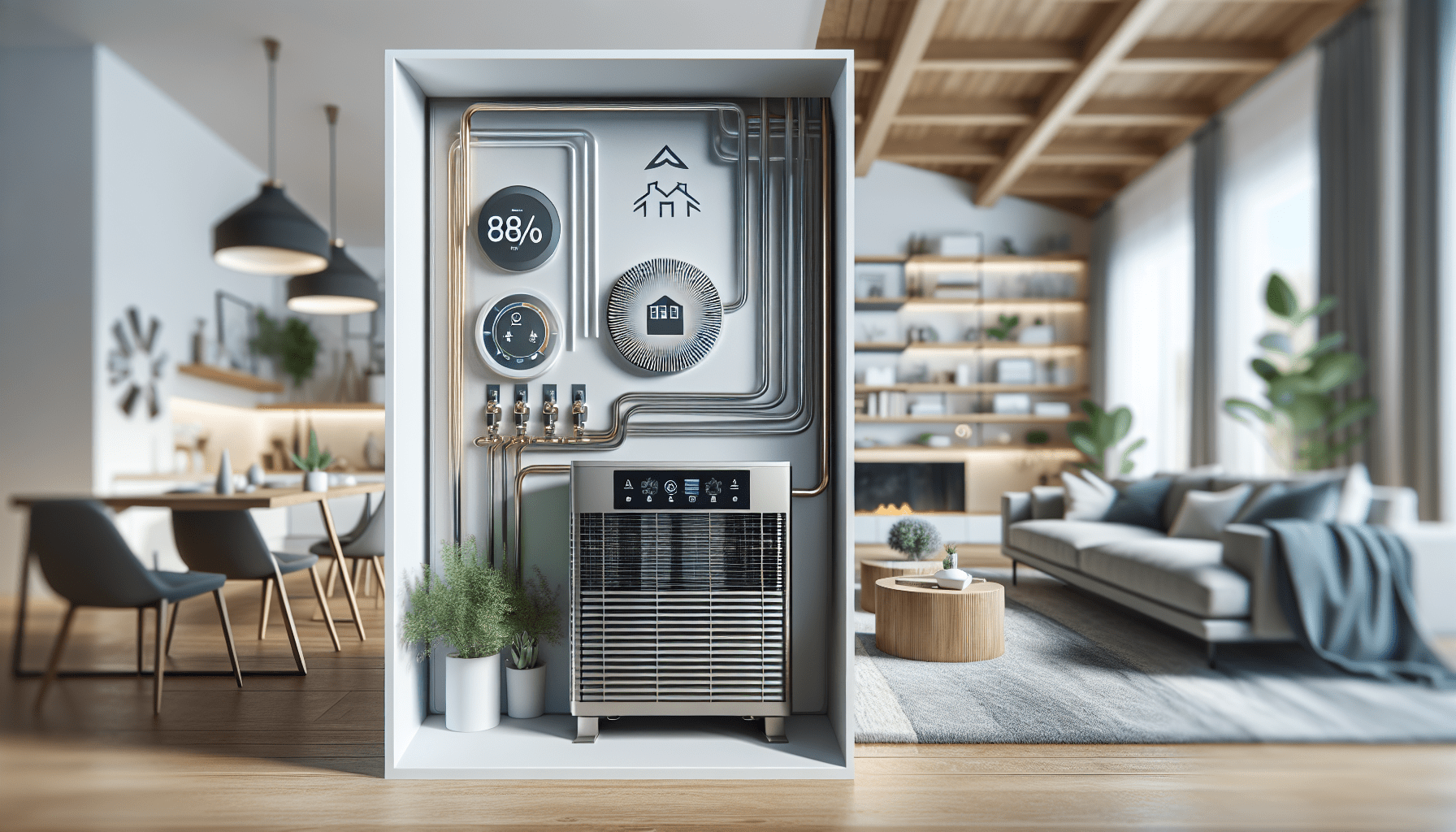

The Importance of HVAC Upgrades

Your heating, ventilation, and air conditioning (HVAC) system is arguably the heart of your home’s comfort. If it’s outdated, inefficient, or breaking down, you’re likely spending more on energy bills than you need to. Besides cost, there’s the environmental impact to consider.

Why Upgrade?

Upgrading to a more efficient HVAC system can lower your energy consumption, resulting in both direct and indirect benefits. Imagine a summer without the constant hum of an overworked AC or a winter without the chills because your heater can’t keep up.

- Lower Energy Bills: New, high-efficiency models consume far less energy than older units.

- Comfort: Modern systems regulate your home’s temperature much more effectively.

- Environment: Less energy consumption means a smaller carbon footprint.

- Home Value: An upgraded, modern HVAC system can increase the market value of your home.

So, we’ve got the “why” down. Now let’s talk about the “how” — specifically, how energy tax credits can ease the burden on your wallet.

Understanding Energy Tax Credits

Tax credits are not the same as tax deductions. A tax deduction reduces the amount of your income that is subject to tax, but a tax credit reduces your tax bill directly.

What Are Energy Tax Credits?

Energy tax credits are incentives offered by federal and state governments to encourage homeowners to make energy-efficient improvements. These credits can offset a substantial portion of the cost of an HVAC upgrade.

- Federal Tax Credits: These are offered by the IRS and can cover various home improvements, including HVAC systems.

- State and Local Credits: Your state or local government might offer additional credits or rebates for energy-efficient upgrades.

How Much Can You Get?

The specifics can vary, but generally, you might be eligible for credits up to 30% of the cost of a qualifying HVAC system, including both equipment and installation.

| Upgrade Type | Potential Tax Credit |

|---|---|

| Central Air Conditioning | Up to $300 |

| Advanced Main Air Circulating Fan | Up to $50 |

| Natural Gas, Propane, or Oil Furnace | Up to $150 |

| Heat Pumps | Up to $300 – $500 |

Keep in mind that these amounts can fluctuate based on legislation and specific qualifications that the installation must meet.

Eligibility Criteria for Energy Tax Credits

Qualifying for energy tax credits involves meeting specific requirements. So, what exactly do you need?

Product Certification

First and foremost, your new HVAC system must meet specific energy efficiency criteria. Look out for:

- ENERGY STAR Certification: Widely recognized, this certification ensures that the product is energy-efficient.

- Manufacturer Certification Statement: This document verifies that the HVAC system meets specific performance standards.

Proper Installation

Even if you have the most efficient unit on the market, poor installation can negate the benefits. Ensure the installer is reputable and understands the regulatory requirements.

Documentation

Keep all receipts, the Manufacturer Certification Statement, and any other relevant paperwork. You’ll need these documents when you file your taxes.

Filing for Energy Tax Credits

You’ve upgraded, you’ve got your documentation, now what? Filing for these tax credits isn’t as daunting as you might think.

IRS Form 5695

To claim your energy credits, you’ll need IRS Form 5695, also titled “Residential Energy Credits”.

- Fill Out the Form: It’s a simple form asking for your expenses and the types of upgrades you’ve made.

- Documentation: Attach all relevant receipts and certifications.

- Submit with Your Tax Return: Include Form 5695 with your regular tax return.

State-specific Forms

Some states have their own forms you’ll need to file in addition to federal paperwork. Check with your state’s tax authority for guidance.

Finding the Right HVAC System

Picking an energy-efficient HVAC system isn’t just about skimming through a catalog. There’s quite a bit to consider, from the size of your home to your specific heating and cooling needs.

What to Look For

- Energy Efficiency Ratio (EER): This measures the system’s efficiency. The higher the EER, the more efficient the unit.

- Seasonal Energy Efficiency Ratio (SEER): Similar to EER, but specific to air conditioners and heat pumps.

- Heating Seasonal Performance Factor (HSPF): This metric applies to heat pumps and measures their efficiency in heating mode.

Professional Advice

Consulting a professional can help you make an informed decision. Experts like those at Tempacure Heating and Air Conditioning can provide insights tailored to your home’s specific needs.

Benefits Beyond Tax Credits

While the primary aim here is to save money through tax credits, upgrading your HVAC system brings other advantages.

Improved Air Quality

Modern HVAC systems come with advanced filters that can improve your home’s air quality, which is especially beneficial for those with allergies or respiratory issues.

Smart Home Integration

Many new systems integrate seamlessly with smart home technology. Imagine controlling your home’s temperature from your smartphone or having your system automatically adjust settings based on your routine.

Reduced Maintenance Costs

A new HVAC system often comes with warranties and less frequent maintenance needs, saving you both time and money over the years.

Choosing a Professional Installer

Getting the right system is only half the battle. Proper installation is crucial for meeting the efficiency standards required for tax credits.

Why Choose Tempacure Heating and Air Conditioning?

Their address is 325 Cedar Ave S, Suite B, Niceville, FL 32578, and they can be reached at (850) 678-2665 or through their website, https://tempacurehvac.com/. They know the ins and outs of energy-efficient systems and can provide a seamless installation process. Plus, they’ll help ensure you meet all the qualifications for those all-important tax credits.

Real-world Examples

Seeing how others have benefited from energy tax credits can also help you understand the potential savings and improvements to your quality of life.

The Smith Family

After moving into a 20-year-old house, the Smiths noticed their energy bills were sky-high. They upgraded their HVAC system to a high-efficiency model and claimed $500 in tax credits, reducing their overall costs significantly.

The Johnson Duo

Emma and John Johnson decided to go green by installing a heat pump in their home. Not only did they see a reduction in their energy bills, but they also claimed a $300 tax credit.

Long-term Financial Impact

Understanding the long-term benefits of upgrading your HVAC system can put the initial cost into perspective.

Return on Investment (ROI)

- Energy Savings: The immediate reduction in energy bills can offset the cost of the new system within a few years.

- Tax Credits: Directly reducing the financial burden right out the gate.

- Increased Home Value: An energy-efficient home can be a major selling point, providing a good return if you ever decide to sell.

Case Study: ROI Calculation

Let’s say you invest $5,000 in a new HVAC system. With estimated annual energy savings of $600 and a $500 federal tax credit, you’re looking at a payback period of about 7.5 years. That’s before considering any state credits or increased home value.

Future Trends in HVAC and Energy Efficiency

As technology evolves, so do your options for energy-efficient home upgrades.

Smart HVAC Systems

The future is here, and it’s intelligent. Smart HVAC systems adapt to your lifestyle, making real-time adjustments to keep you comfortable.

Next-gen Energy Sources

Geothermal and solar-powered HVAC systems are becoming more mainstream, offering even greater efficiency and potential for additional tax incentives.

Conclusion

By understanding the ins and outs of energy tax credits for HVAC upgrades, you’re not just making a smart financial decision but also contributing positively to the environment. Isn’t it a great feeling knowing you’re doing good for your wallet and the planet?

If you’re ready to make the leap, consider reaching out to professionals like those at Tempacure Heating and Air Conditioning, based at 325 Cedar Ave S, Suite B, Niceville, FL 32578. Give them a call at (850) 678-2665, or check out their services at https://tempacurehvac.com/.

Upgrading your HVAC system might seem overwhelming, but armed with the right knowledge and professional help, you’re well on your way to a more energy-efficient, comfortable, and cost-effective home.